The Real Cost of Financial Anxiety: A Neurodivergent Perspective

My heart rate spikes before I even open the banking app.

That familiar tightness in my chest. The sudden urge to close the tab and pretend everything’s fine. The shame spiral that starts before I’ve even seen the number.

If you know this feeling, you’re not alone. Financial anxiety isn’t just “stress about money”—for neurodivergent folks, it’s a full-body experience that can derail our entire day.

The Physical Reality of Money Anxiety

Financial anxiety isn’t just in your head. It’s:

- Physical: Racing heart, sweating, nausea, headaches

- Emotional: Shame, panic, despair, overwhelm

- Cognitive: Brain fog, inability to focus, catastrophic thinking

- Behavioral: Avoidance, impulsive spending, paralysis

For those of us with ADHD, anxiety disorders, or mood disorders like bipolar, these symptoms hit different. They compound with our existing challenges, creating a perfect storm of avoidance.

The Avoidance Trap

Here’s the cruel irony: The more we avoid our finances, the worse they get. But the worse they get, the harder it becomes to look.

I once went three months without checking my bank balance. Three months of:

- Declining cards at the grocery store

- Overdraft fees piling up

- Bills going unpaid

- Credit score tanking

Each day I didn’t look, the monster under the bed grew bigger. By the time I finally checked, the damage was devastating—both financially and emotionally.

Why “Just Check Your Balance” Doesn’t Work

Neurotypical financial advice assumes checking your balance is neutral. For us, it’s not:

Executive Dysfunction: On bad brain days, even opening an app feels impossible

Rejection Sensitive Dysphoria: Seeing a low balance feels like personal failure

Time Blindness: “I’ll check later” becomes weeks of avoidance

Emotional Dysregulation: One bad number can spiral into hours of panic

All-or-Nothing Thinking: “If I can’t fix it all right now, why look?”

The Hidden Costs We Don’t Talk About

Financial anxiety costs more than money:

Relationships: Hiding spending from partners, avoiding social events we can’t afford

Career: Missing opportunities because we’re too anxious to negotiate or change jobs

Health: Stress-related illness, avoiding medical care we can’t afford

Self-Worth: Internalizing financial struggles as personal failure

Daily Life: Every purchase becomes a source of anxiety, even necessary ones

What Actually Helps: A Neurodivergent Approach

After years of fighting financial anxiety, here’s what actually works:

1. Reduce Decision Fatigue

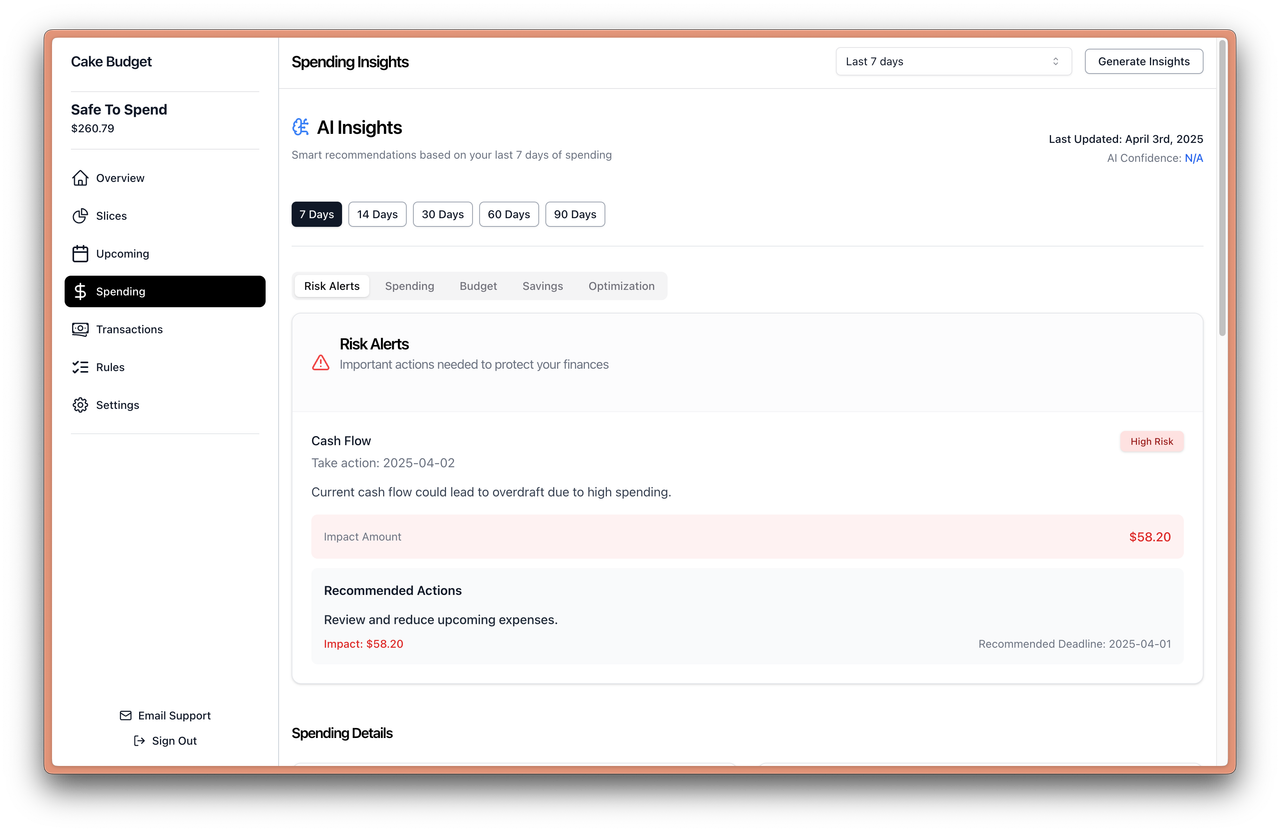

The traffic light system changed everything for me. Green = safe. Yellow = careful. Red = stop. No math, no analyzing, no spiraling. Just a color.

2. Build Gentle Check-In Habits

Instead of “review your finances weekly,” try:

- Glance at your traffic light with morning coffee

- Set a “vibe check” alarm—just see the color, not the number

- Pair checking with something comforting (favorite music, cozy blanket)

3. Automate the Scary Stuff

- Auto-import transactions (no manual entry guilt)

- Rules that categorize spending (no decision fatigue)

- Scheduled funding (paychecks distribute themselves)

The less you have to actively manage, the less anxiety triggers.

4. Start with Safety

Before you can build wealth, you need to feel safe. For me, that meant:

- Knowing at a glance if I could buy groceries

- Seeing patterns without doing math

- Having guardrails for impulsive moments

5. Progress Over Perfection

- Checked your balance today? Win.

- Stayed in green for a day? Win.

- Didn’t overdraft this week? Win.

Small wins rebuild confidence. Confidence reduces anxiety.

The Day Everything Changed

I’ll never forget the first time I checked my balance without my heart racing.

After months of using visual indicators instead of numbers, something shifted. The traffic light had trained my nervous system: Green meant safety. My body learned that checking didn’t always mean danger.

That’s when I realized: The goal isn’t to eliminate financial anxiety. It’s to build tools and habits that work with our brains, not against them.

You Deserve Financial Peace

Financial anxiety isn’t a character flaw. It’s a rational response to:

- Living paycheck to paycheck

- Managing neurodivergent challenges

- Existing in a system not built for us

You deserve tools that:

- Reduce anxiety instead of creating it

- Work on your worst brain days

- Help without shaming

- Meet you where you are

Financial peace doesn’t mean being rich. It means being able to check your balance without panic. It means knowing if you can buy groceries without doing mental math in the store. It means feeling safe.

That’s not too much to ask.

Ready for a gentler way to manage money? Try Cake Budget free for 14 days. Built by someone who gets the anxiety. No credit card required.