Budgeting for Irregular Income 💰

Whether you're driving for DoorDash, freelancing, or juggling multiple gigs, Cake Budget adapts to your income reality. Give every paycheck a purpose, no matter when it arrives.

Traditional Budgets Weren't Built for You

Unpredictable Income

Our solution: Track multiple income streams separately

Feast or Famine Cycles

Our solution: Smart averaging and cushion building

Tax Confusion

Our solution: Automatic tax slice allocation

No Safety Net

Our solution: Emergency fund automation

"Give every paycheck a purpose" - not just every dollar. Because your paychecks come when they come.

Features Built for Your Reality

Multiple Income Tracking

DoorDash on Monday, Uber on Tuesday, freelance on Friday? Track each stream separately.

Tax Slice Automation

Automatically set aside 25-30% for taxes. Never get caught off guard in April.

Income Averaging

See your real average income over 30, 60, or 90 days. Plan with confidence.

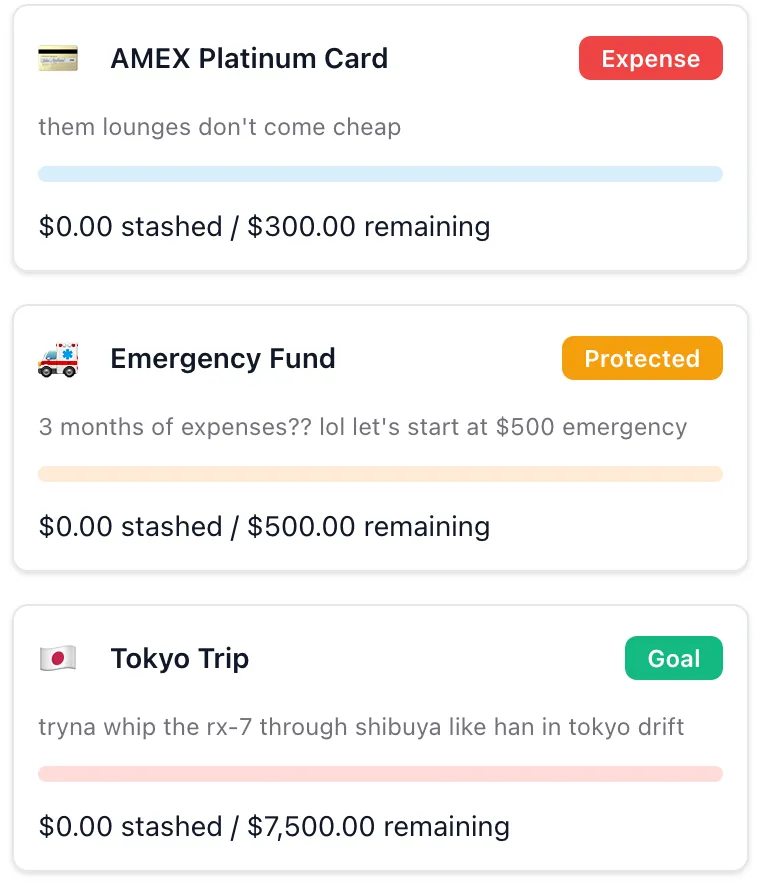

Goal-Based Budgeting

Set weekly or monthly income goals. Track progress in real-time.

Smart Paycheck Detection

Automatically categorize income by source. Know which gigs pay best.

Flexible Thresholds

Adjust your traffic light based on this week's earnings. Stay realistic.

How Cake Budget Works for Gig Workers

Connect All Income Sources

Link your business checking, PayPal, Stripe, or wherever your money lands. See everything in one place.

Set Up Smart Rules

"When DoorDash pays me, save 30% for taxes." "When client invoice hits, fund emergency slice." Automate your system.

Give Each Paycheck Purpose

Monday's Uber earnings? That's for groceries. Friday's freelance check? Straight to rent. Every dollar has a job.

Check Your Traffic Light

Green light? Treat yourself. Yellow? Maybe wait for tomorrow's gigs. Red? Time to hustle. Visual clarity, always.

Built for Every Type of Gig Worker

The Multi-App Driver

Your situation: Drive for Uber, DoorDash, and Instacart

Cake Budget helps: See combined earnings across all apps in one place.

The Creative Freelancer

Your situation: Mix of client work, Fiverr gigs, and Etsy sales

Cake Budget helps: Track project income separately. Never lose track of who paid what.

The Side Hustler

Your situation: 9-5 job plus weekend gig work

Cake Budget helps: Keep gig money separate. See exactly what your side hustle adds.

The Seasonal Worker

Your situation: Busy seasons and slow periods

Cake Budget helps: Build cushions during busy times. Navigate slow seasons confidently.

Never Get Surprised by Taxes Again

Set up a tax slice that automatically gets funded with every gig payment. Come tax time, the money's already there. No scrambling, no stress.

How It Works:

Create a "Taxes" slice and set up a rule: "When income arrives, move 25-30% to tax slice." That's it. The money is set aside automatically, ready when you need it.

What Cake Budget Actually Does for Gig Workers

See Everything in One Place

All your income streams - Uber, DoorDash, freelance work - visible in a single dashboard. No more checking multiple apps.

Automate Tax Savings

Set rules to automatically move a percentage of income to your tax slice. Never scramble for tax money again.

Know Your Spending Power

Traffic light shows if you can afford something based on all your income and expenses combined.

Build Emergency Funds

Create slices for slow seasons. Automate savings during good weeks to cushion the lean times.

Your Income is Irregular. Your Budget Doesn't Have to Be.

Track every income stream, save for taxes automatically, and always know where you stand. Built by someone who gets the gig economy struggle.

No credit card required • Perfect for 1099 workers

Real Gig Worker Setups

Full-Time Rideshare

Lisa: Uber/Lyft driver, $800-$1,500/week (varies)

Setup: Every deposit auto-funds: 30% taxes, 20% car maintenance, 10% gas, rest to bills. "Emergency Car Fund" slice builds $2,000 cushion. Traffic light keeps spending in check during slow weeks.

Multi-App Delivery

Carlos: DoorDash + Uber Eats + Instacart, daily deposits

Setup: All deposits treated the same: 25% to protected tax slice, 75% to Safe-to-Spend. Rent slice gets $500 auto-contribution every week. Tracks gas expenses in "Business Costs" for tax deductions.

Freelance Writer

Taylor: Multiple clients, $2k-$5k/month (project-based)

Setup: Each client payment triggers automation: 30% taxes, 20% health insurance, 50% bills/living. "Slow Month Buffer" holds 2 months expenses. Protected slices prevent accidental spending of tax money.

Amazon Flex Driver

Jordan: 20-30 hours/week, weekly deposits $400-$700

Setup: First $500 each week auto-funds rent and utilities. Everything above goes 40% savings, 30% fun money, 30% emergency fund. Traffic light turns yellow at $100, red at $0 to prevent overdrafts.

Gig Worker Budgeting FAQ

How do I budget when my income changes every week?

That's exactly what Cake Budget is built for! Instead of planning months ahead, you work with what's actually in your account right now. Your Safe-to-Spend updates in real-time as money comes in. Create slices for essentials first (rent, groceries), then allocate extra income when it arrives using funding schedules.

Can I track income from DoorDash, Uber, and Instacart separately?

Yes! Set up automation rules that categorize deposits based on amount patterns or descriptions. Each platform can have its own funding schedule that kicks in when that specific paycheck arrives. You'll see exactly how much each gig contributes to your budget.

How do I save for taxes on irregular income?

Create a "Tax Savings" protected slice and set up funding schedules to automatically set aside 25-30% of every gig deposit. Mark it as "protected" so it doesn't count toward your Safe-to-Spend. When quarterly taxes are due, the money's already there waiting.

What if I have a really slow week?

Your traffic light system adjusts automatically. If income is low, you'll see yellow or red faster, warning you to slow spending. Build an "Emergency Buffer" slice during good weeks to cushion slow periods. The system helps you spend less when you're earning less—no mental math required.

Does it handle daily deposits from gig apps?

Absolutely! Syncing via Plaid means every deposit updates your budget throughout the day. DoorDash instant pay at 11pm? It's in your Safe-to-Spend within minutes. Your funding schedules can run daily, weekly, or whenever income hits—however you get paid.

Can I track business expenses for taxes?

Create a "Business Expenses" slice and use automation rules to categorize things like gas, car maintenance, phone bills, etc. At tax time, you'll have a clear record of deductible expenses. For detailed tracking, you can also split transactions between personal and business use.

What plan do I need as a gig worker?

If you use 1 bank account, Starter ($5/month) works perfectly. Most gig workers with 1-2 accounts use Budget Pro ($10/month, 2 bank connections). Only need Family ($20/month, 5 bank connections) if you're managing business and personal across 3+ different banks. Start with the 14-day trial to test it out!