Working Multiple Jobs? We Get It. 💪

Whether you're working two jobs to pay off debt, save for a dream, or just make ends meet, Cake Budget helps you keep it all straight. No judgment, just support for your hustle.

Traditional Budgets Don't Work for Multiple Jobs

Different Pay Schedules

Our solution: Smart Paycheck Funding handles each schedule automatically

Mixed W-2 and 1099 Income

Our solution: Protected tax slices for 1099s, regular tracking for W-2s

Multiple Financial Goals

Our solution: Create separate slices funded by specific jobs

Seasonal Income Variation

Our solution: Build buffers during busy seasons for slow periods

💪 Working multiple jobs isn't a failure—it's being responsible. Whether you're supporting a family, chasing a dream, or just making it work, we're here to help.

Built for Your Reality

Every feature designed to handle the chaos of juggling multiple paychecks and schedules.

Smart Paycheck Funding

Set automatic funding schedules for each job. Biweekly, monthly, weekly - we handle them all.

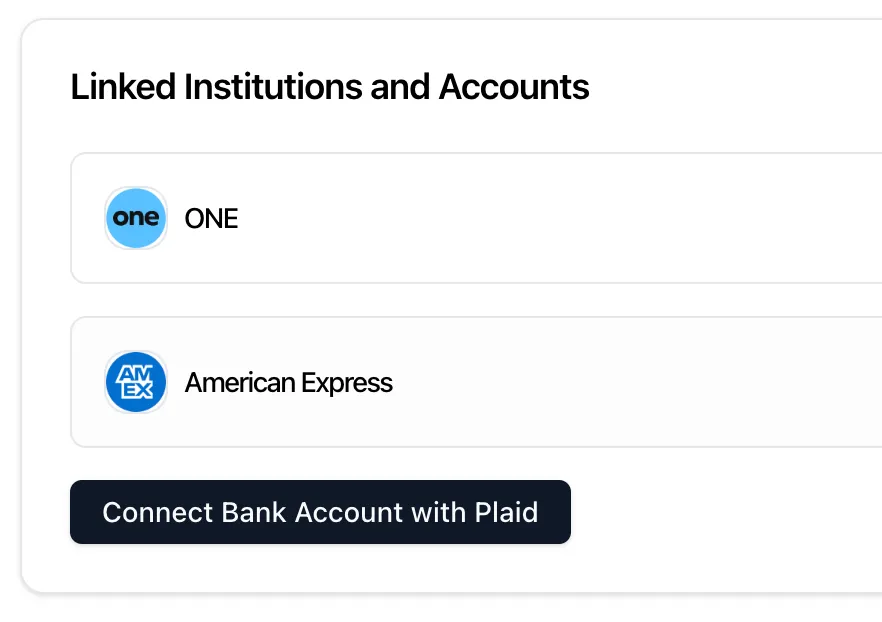

Multiple Bank Support

Connect accounts from different banks. See all your income sources in one dashboard.

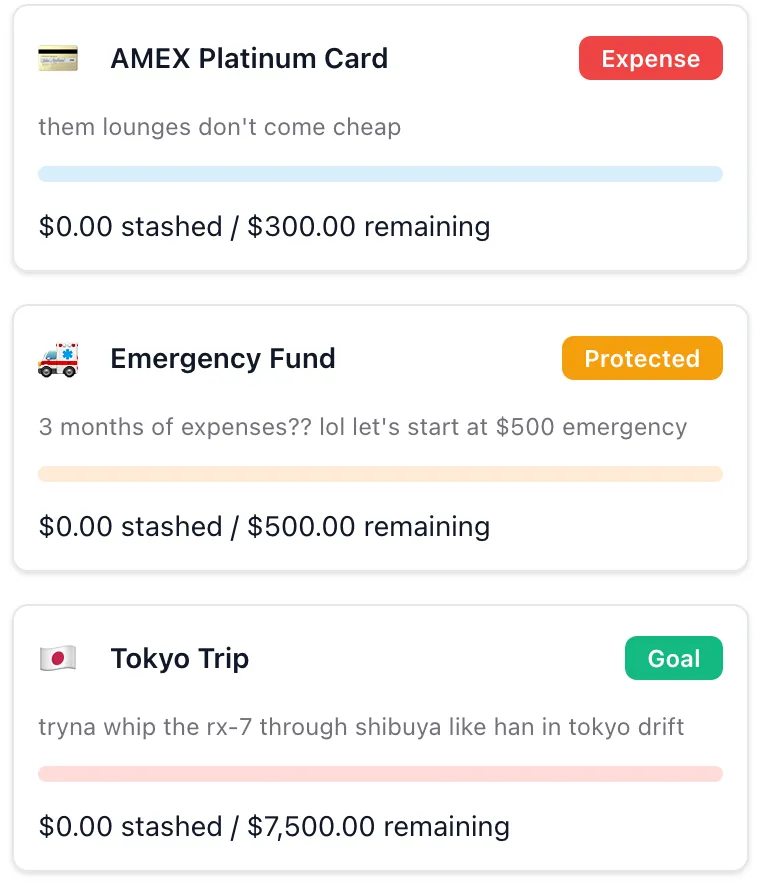

Purpose-Driven Slices

Create virtual envelopes for bills, savings, taxes, fun. Fund them from specific paychecks.

Real-Time Updates

Transactions sync throughout the day. See every paycheck the moment it hits.

Automation Rules

Set up transaction categorization and funding rules once. They run forever.

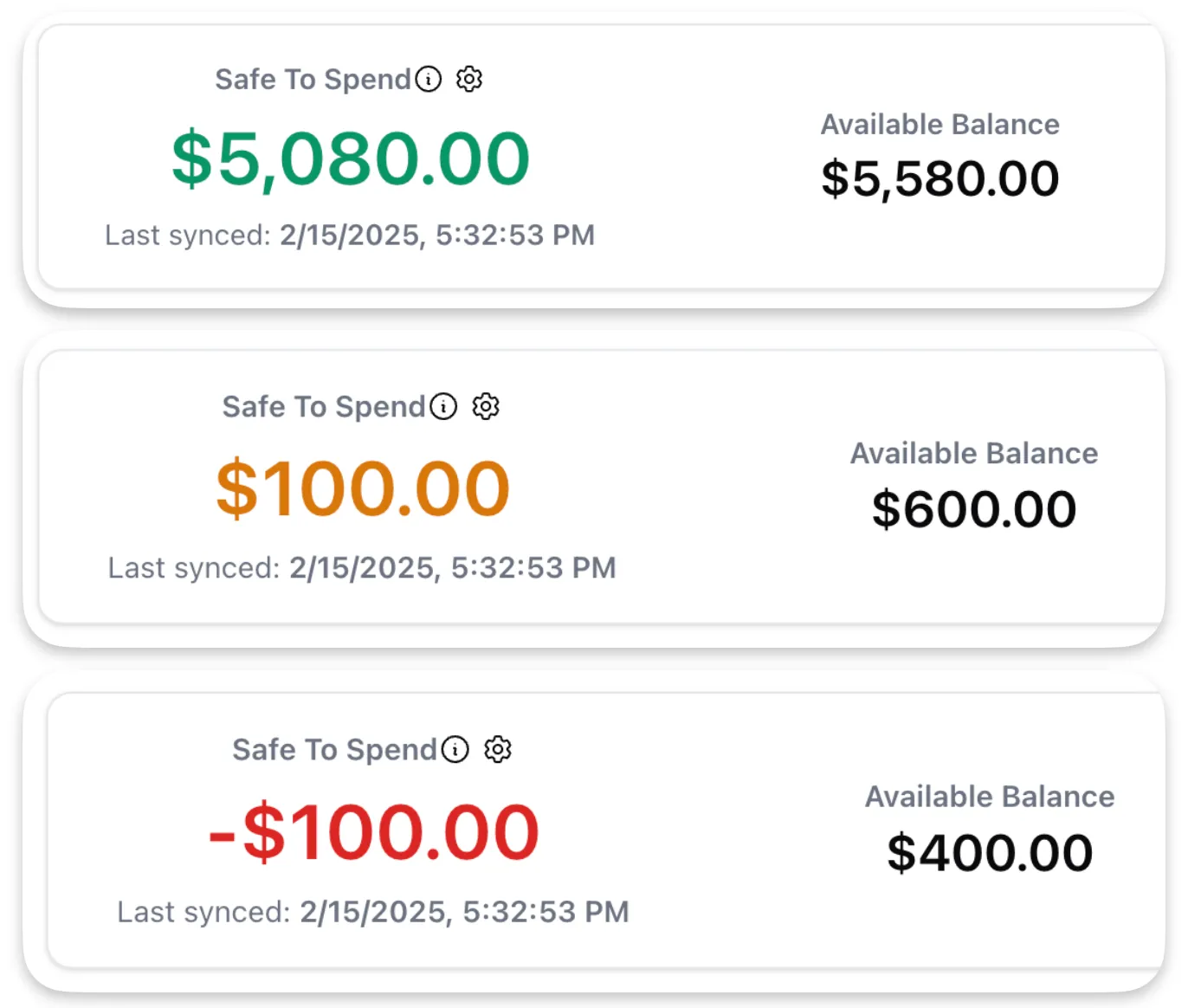

Traffic Light Spending

Green, yellow, or red across all accounts. Know instantly if you can afford that purchase.

We Solve the Real Challenges

Multiple Pay Schedules

Different jobs pay on different schedules? Smart Paycheck Funding handles each one automatically.

Tax Planning

Create protected tax slices. Auto-fund them from 1099 income while leaving W-2 paychecks alone.

Transaction Categorization

Rules engine automatically sorts transactions. Split expenses across multiple slices when needed.

Purpose-Driven Budgeting

Create goal slices with target amounts and dates. See exactly which jobs are funding which goals.

Perfect for Real People

Built for teachers, nurses, retail workers—anyone juggling multiple paychecks.

The Debt Crusher

Teacher by day, bartender by night to pay off loans

Dedicate bartending income to debt slice with automatic funding.

The Dream Saver

Nurse with weekend retail job saving for house

Create house down payment goal slice funded by weekend job.

The Buffer Builder

Seasonal worker building emergency fund

Use busy season earnings to fund emergency slices for slow times.

The Goal Juggler

Three part-time jobs, multiple financial goals

Create separate slices and funding schedules for each income stream.

All Your Jobs, One Dashboard

Connect accounts from different banks. See your complete financial picture across all your income sources in real-time.

Features That Actually Help

Traffic Light Spending

Green, yellow, or red across all your accounts. Know instantly if you can afford that purchase.

Virtual Envelope System

Create slices for each purpose: bills, savings, taxes, fun. Money stays in your accounts - tracking is virtual.

Real-Time Updates

Transactions sync throughout the day. See every paycheck the moment it hits.

Automation Rules

Set up rules once, they run forever. Auto-categorize transactions and fund slices.

Know What's Safe to Spend

The traffic light system gives you instant visual feedback. Green means go, yellow means caution, red means stop.

Organize Every Dollar with Purpose

Create slices for bills, emergency fund, debt payoff, and goals. Set up automatic funding from specific jobs.

No Shame, Just Support

Working multiple jobs isn't a failure—it's being responsible. Whether you're supporting a family, chasing a dream, or just making it work, we're here to make the financial side easier.

You're already working hard enough. Let us handle the budget math.

Looking for Something More Specific?

Real Scenarios from Multi-Job Workers

Teacher + Retail

Sarah: Full-time teacher (bi-weekly) + weekend retail (weekly)

Setup: Teaching income covers bills via funding schedule. Retail income goes to "Extra Money" slice for savings and fun. Traffic light keeps her from overspending between retail checks.

Nurse + Per Diem

Marcus: Hospital (bi-weekly) + per diem shifts (irregular)

Setup: Hospital income auto-funds essentials. Per diem deposits trigger a rule that splits 50% to emergency fund, 50% to vacation slice. Never touches per diem for daily expenses.

Office + Freelance

Alex: 9-5 office job (monthly) + freelance design (project-based)

Setup: Office salary covers living expenses automatically. Freelance payments go 30% to taxes, 40% to student loans, 30% to travel fund. Keeps freelance and salary income completely separate.

Two Part-Time Jobs

Jamie: Coffee shop (weekly) + pizza delivery (weekly, different days)

Setup: First paycheck of the week funds rent slice. Second paycheck funds groceries and utilities. Tips from both jobs go to "Cushion" slice for irregular weeks. Safe-to-Spend prevents overspending.

Multiple Jobs FAQ

How do I handle two different pay schedules?

Set up separate funding schedules for each job! Job 1 bi-weekly? Create a bi-weekly schedule. Job 2 weekly? Create a weekly one. Smart Paycheck Detection recognizes which paycheck is which and runs the right schedule automatically.

Can I prioritize one job's income over another?

Absolutely! For example, main job covers bills and groceries automatically via funding schedule. Second job funds savings, debt payoff, or fun money. You decide which income goes where by setting up different slice allocations in each funding schedule.

What if one job's hours fluctuate?

Your Safe-to-Spend adjusts automatically! If Job 2's paycheck is smaller this week, you'll see yellow or red earlier. Build a "Buffer" slice during good weeks to cushion the low weeks. The traffic light warns you to spend less when income dips.

How do I save money when juggling multiple jobs?

Automate it! Set Job 2's funding schedule to send a percentage to your "Savings" slice every paycheck. Even if it's just $20/week, automation makes it happen without thinking. You can also set up auto-contributions that pull from Safe-to-Spend gradually.

Can I track which job pays for what?

Yes, through slice naming and funding schedules! Create slices like "Bills (Main Job)" and "Fun Money (Side Gig)". Each funding schedule shows you exactly which paycheck funded which slice. You can review funding history to see the breakdown.

What if I quit one of my jobs?

Simply pause or delete that job's funding schedule. Your other job continues funding slices as normal. Your Safe-to-Spend recalculates based on your remaining income. You can adjust slice funding amounts to match your new income reality.

Do I need a special plan for multiple jobs?

Nope! If both jobs deposit into the same bank account, Starter ($5/month, 1 bank connection) works great. If you use 2 different banks, get Budget Pro ($10/month, 2 bank connections). The features are the same—it's just about how many banks you connect.

Ready to Simplify Your Multi-Job Life?

14-day free trial. No credit card required. Built for people who work hard.