Managing J1, J2, and J3 Without Three Spreadsheets 💼

Whether you call them J1, J2, and J3, or just "multiple revenue streams," Cake Budget handles your income complexity without judgment. Built by someone who understands that traditional budgeting apps weren't designed for your lifestyle.

Traditional Budgets Weren't Built for OE Life

Multiple Pay Schedules

Our solution: Smart Paycheck Funding handles each schedule automatically

Different Bank Accounts

Our solution: Connect up to 5 banks, see everything in one dashboard

Tax Planning Complexity

Our solution: Protected tax slices with automatic funding

Income Purpose Confusion

Our solution: Assign each job to specific slices and goals

💼 Stop managing J1, J2, and J3 in three different spreadsheets. Cake Budget handles your income complexity without judgment.

Built for Your Complex Reality

Every feature designed to handle the unique challenges of managing multiple full-time incomes.

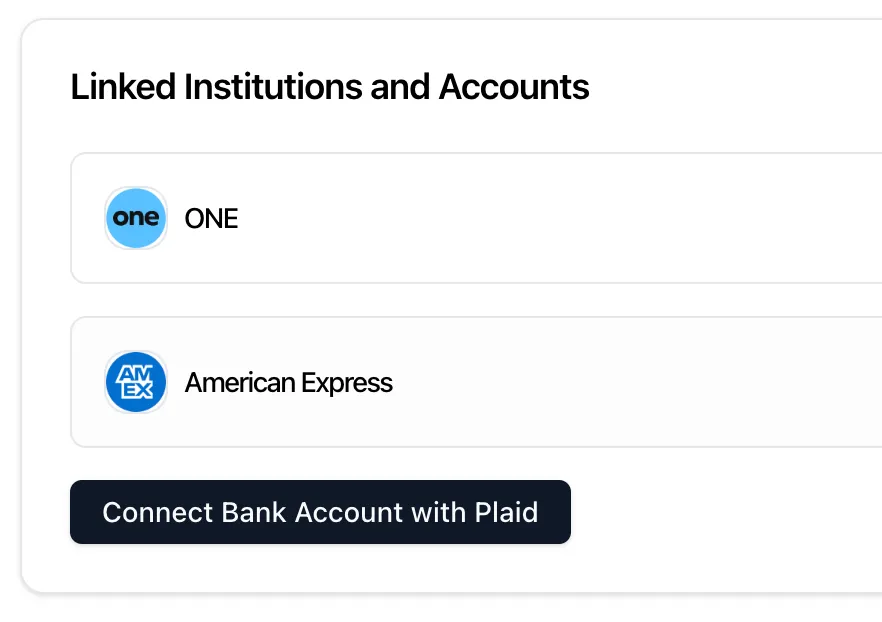

Multiple Bank Connections

Connect accounts from different banks. Family plan supports up to 5 bank connections.

Smart Paycheck Funding

Set J1 for bills, J2 for savings, J3 for taxes. Each paycheck funds the right slices automatically.

Protected Tax Slices

Create slices that can't be touched. Auto-fund them from each paycheck for tax safety.

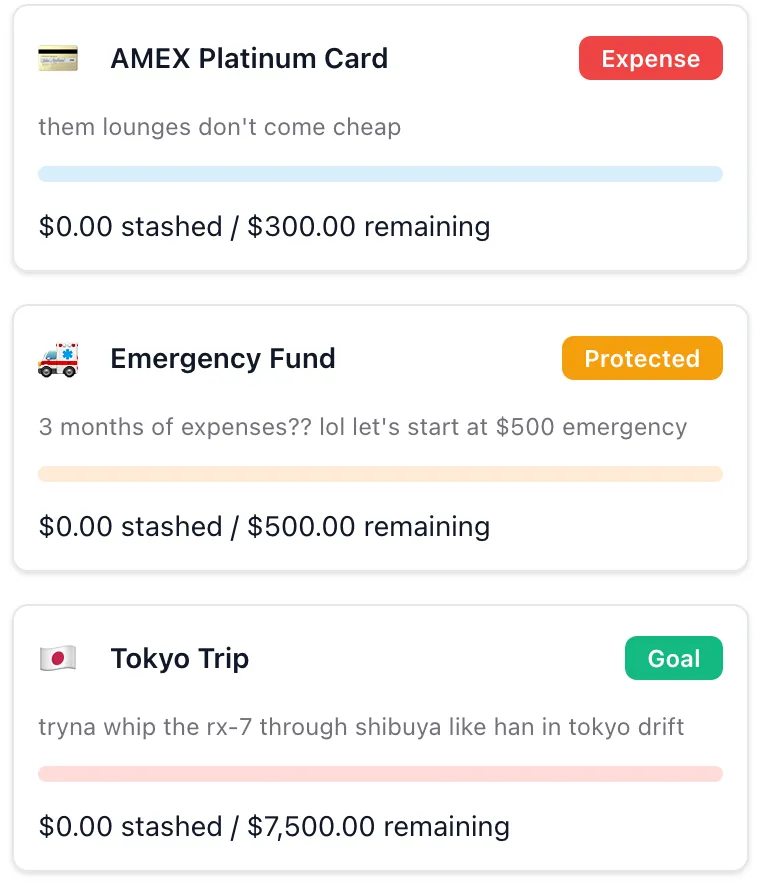

Goal Slice Tracking

Dedicate specific income streams to specific goals with progress tracking and target dates.

Real-Time Updates

See income from all jobs throughout the day. No waiting for daily batch updates.

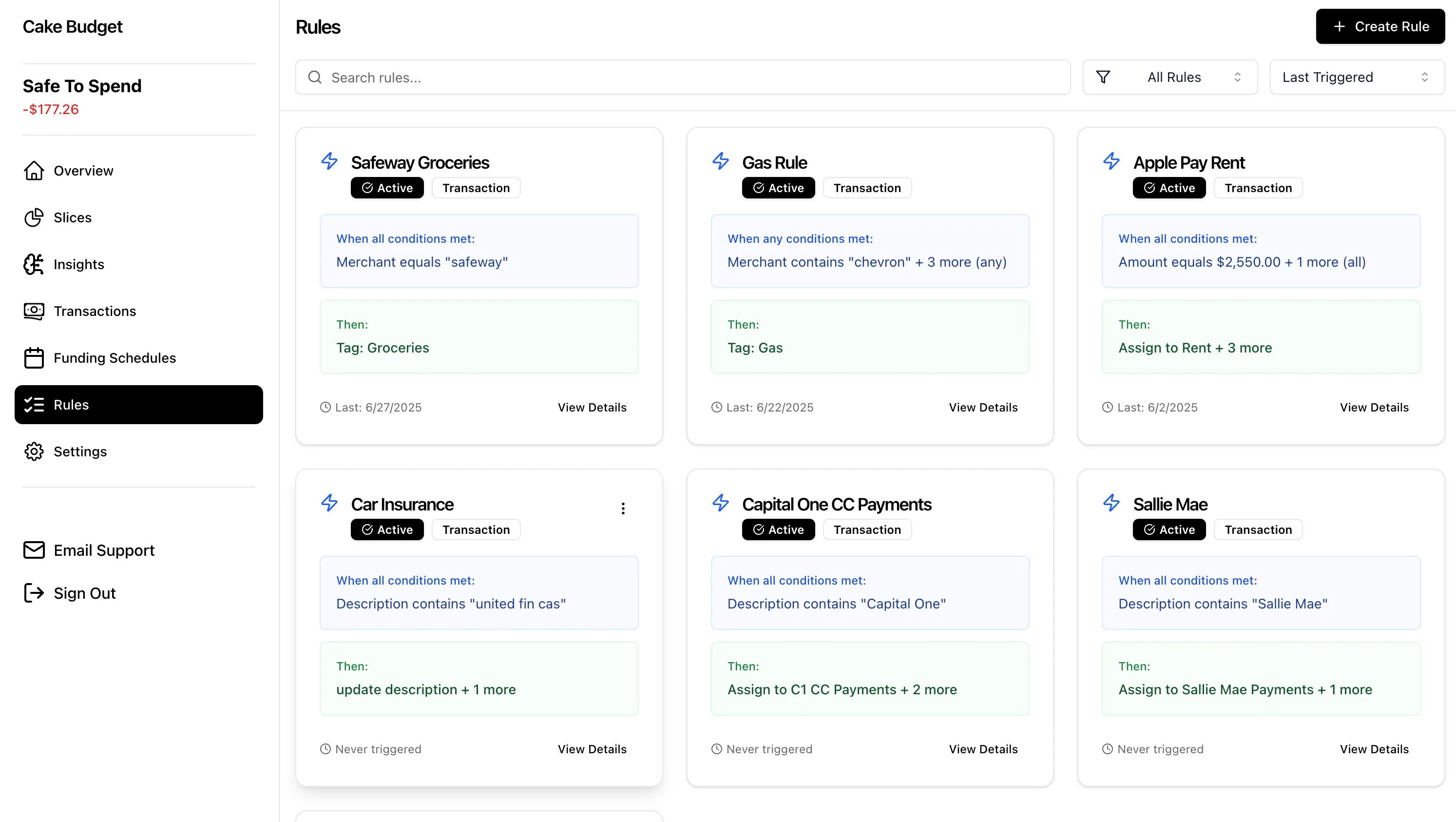

Automation Rules

Set up transaction categorization and funding rules once. They run forever.

Connect All Your Job Accounts

Link accounts from different banks where you receive J1, J2, and J3 paychecks. See everything in one secure dashboard.

Features Built for Your Lifestyle

Virtual Envelope System

Create slices for taxes, emergency funds, debt payoff, and goals. Money stays in your accounts - tracking is virtual.

Automated Funding Rules

Set up once: which paychecks fund which slices. Every deposit gets distributed automatically.

Traffic Light Spending

Green, yellow, or red - know instantly if you can afford that purchase across all your accounts.

AI Insights

Get personalized recommendations for optimizing your multiple income streams and spending patterns.

Organize Your Money with Purpose

Create slices for taxes, emergency funds, specific goals. Assign different jobs to fund different purposes automatically.

Set It and Forget It Automation

Create rules once, they run forever. Automatically categorize transactions and fund the right slices from the right paychecks.

No Judgment, Just Support

We don't care why you have multiple jobs. Maybe you're paying off debt, saving for a house, or just maximizing your earning years. What matters is having a budget that actually works with your reality.

Built by someone who gets it. Designed for people living it.

Who This Is Perfect For

Real people using multiple income streams strategically.

The Strategic Spender

Use J1 for living expenses, J2 for aggressive debt payoff

Create debt slices with automatic funding from specific paychecks.

The Goal Saver

J3 goes straight to house down payment slice

Track progress with visual goal slices and target dates.

The Tax Preparer

Create protected tax slices from each paycheck

Never scramble to find tax money again.

The Safety Builder

Dedicate one income stream to emergency fund

Watch it grow with automatic contributions and progress tracking.

Your Privacy Matters

Bank-level encryption via Plaid. Read-only access only. We never see account numbers or personal details - just transaction data for budgeting.

Real OE Financial Setups

Software Engineer - J1 + J2

David: J1 ($120k/year) + J2 ($90k/year), both bi-weekly

Setup: J1 auto-funds all living expenses and bills. J2 goes 100% to investments and house down payment fund. Protected slices keep J2 income separate. Can quit J2 anytime without lifestyle impact.

Designer - J1 + J2 + J3

Sam: J1 full-time ($65k) + J2 contract ($50k) + J3 part-time ($30k)

Setup: J1 covers essentials, J2 pays off student loans aggressively ($2k/month), J3 builds emergency fund. Three separate funding schedules. Traffic light based only on J1 income for safety.

Data Analyst - Stable + Volatile

Maria: J1 stable ($75k/year) + J2 startup equity ($80k/year, risky)

Setup: Lives entirely off J1. J2 income goes 50% to "Startup Risk Buffer" (protected, holds 6 months expenses), 50% to aggressive investing. If J2 ends, already has 6-month cushion built.

Project Manager - Aggressive Saver

Alex: J1 ($85k/year) + J2 ($70k/year), aiming for FIRE

Setup: J1 funding schedule handles all expenses. J2 split: 30% taxes, 70% to "FIRE Fund" (protected). Goal is $500k in 3 years. Automation ensures every J2 paycheck goes to goal, zero lifestyle inflation.

Common Questions About OE Budgeting

Can I really separate my J1, J2, and J3 income streams?

Yes! Each paycheck can automatically fund different slices based on which job it's from. Set up separate funding schedules for J1 (covering bills), J2 (investing/saving), and J3 (debt payoff or fun money). Your automation rules can categorize expenses by source too.

How do I handle different pay schedules across jobs?

Smart Paycheck Detection recognizes each income source automatically and runs the corresponding funding schedule. J1 bi-weekly, J2 monthly, J3 weekly? No problem. Each schedule is independent and runs when that specific paycheck hits your account.

Is my data secure? I need discretion.

Bank-level encryption via Plaid (SOC 2 Type II certified). We have read-only access and can never move money. Your data is encrypted at rest and in transit. We never sell data, and if you delete your account, everything is permanently removed within 30 days.

What if one job ends suddenly?

Simply pause or delete that funding schedule. Your remaining jobs continue operating normally. Your Safe-to-Spend instantly recalculates based on remaining income. You can also create an "emergency fund" slice that builds up gradually for this exact scenario.

Can I track which expenses come from which job's income?

While transactions themselves aren't tagged by income source, you can structure your slices to track this. For example: "Bills (J1 funded)", "Investments (J2 funded)", "Debt Payoff (J3 funded)". Each slice shows its funding history and spending.

Do I need the Family plan for multiple jobs?

Not necessarily! If you use 1 bank, Starter ($5/month, 1 bank connection) works. If you use 2 banks, Budget Pro ($10/month, 2 bank connections) is perfect. Only need Family ($20/month, 5 bank connections) if you have 3+ different banks. Most OE folks keep everything at 1-2 banks.

Ready to Simplify Your Complex Finances?

14-day free trial. No credit card required. Cancel anytime.