Why Your Budget Fails Every Time (And How to Break the Cycle)

I’ve abandoned more budgets than I can count.

Excel spreadsheets with color-coded categories. YNAB with its zero-based budgeting philosophy. Mint with its endless categorization. Rocket Money with its net worth tracking and investment dashboards. Each time, I’d start with determination. This would be the one. This would finally work.

Two weeks later? Abandoned. Again.

If this sounds familiar, you’re not alone. And more importantly: it’s not your fault.

The Shame Spiral of Failed Budgets

Here’s how it usually goes:

- Day 1-3: Hyperfocus kicks in. You categorize everything. You’re going to track every penny.

- Week 1: You miss logging a few transactions. The guilt starts.

- Week 2: You avoid opening the app because you’re “behind” on tracking.

- Week 3: Full avoidance mode. Another budget bites the dust.

- Month 2: “Maybe I’m just bad with money.”

Sound familiar? This isn’t a personal failing. It’s a fundamental mismatch between how these tools work and how our brains work.

Why Traditional Budgeting Apps Miss the Mark

Most budgeting apps make assumptions that don’t fit our reality:

They assume you have investments to track When you’re living paycheck to paycheck, net worth tracking feels like salt in the wound. I don’t need to know my net worth is negative. I need to know if I can buy groceries.

They assume one stable job Gig workers, freelancers, and folks juggling multiple income streams get lost in apps built for salary earners. When your income varies wildly, traditional budgets break.

They assume neurotypical executive function

- “Just track every expense” (requires consistent memory)

- “Review weekly” (requires routine maintenance)

- “Plan months ahead” (requires predictive thinking)

- “Adjust when you overspend” (ignores shame spirals)

They focus on wealth building, not surviving Investment allocation and retirement planning are important—for people who aren’t choosing between gas and groceries. We need tools for making it to next Friday, not retiring at 65.

The All-or-Nothing Trap

With ADHD, we often operate in extremes. Either we’re tracking every cent obsessively, or we’re avoiding our finances entirely. There’s no middle ground.

Traditional budgets feed this pattern:

- Miss one day of tracking? The whole system feels “ruined”

- Go over budget once? Might as well give up

- Can’t predict next month? Why even try?

This perfectionism isn’t sustainable. And when we inevitably fall short of perfect, we internalize it as personal failure rather than recognizing the system wasn’t built for us.

What Actually Works: Principles for Neurodivergent Budgeting

After years of failed budgets, here’s what I’ve learned actually works:

1. Visual Over Numerical

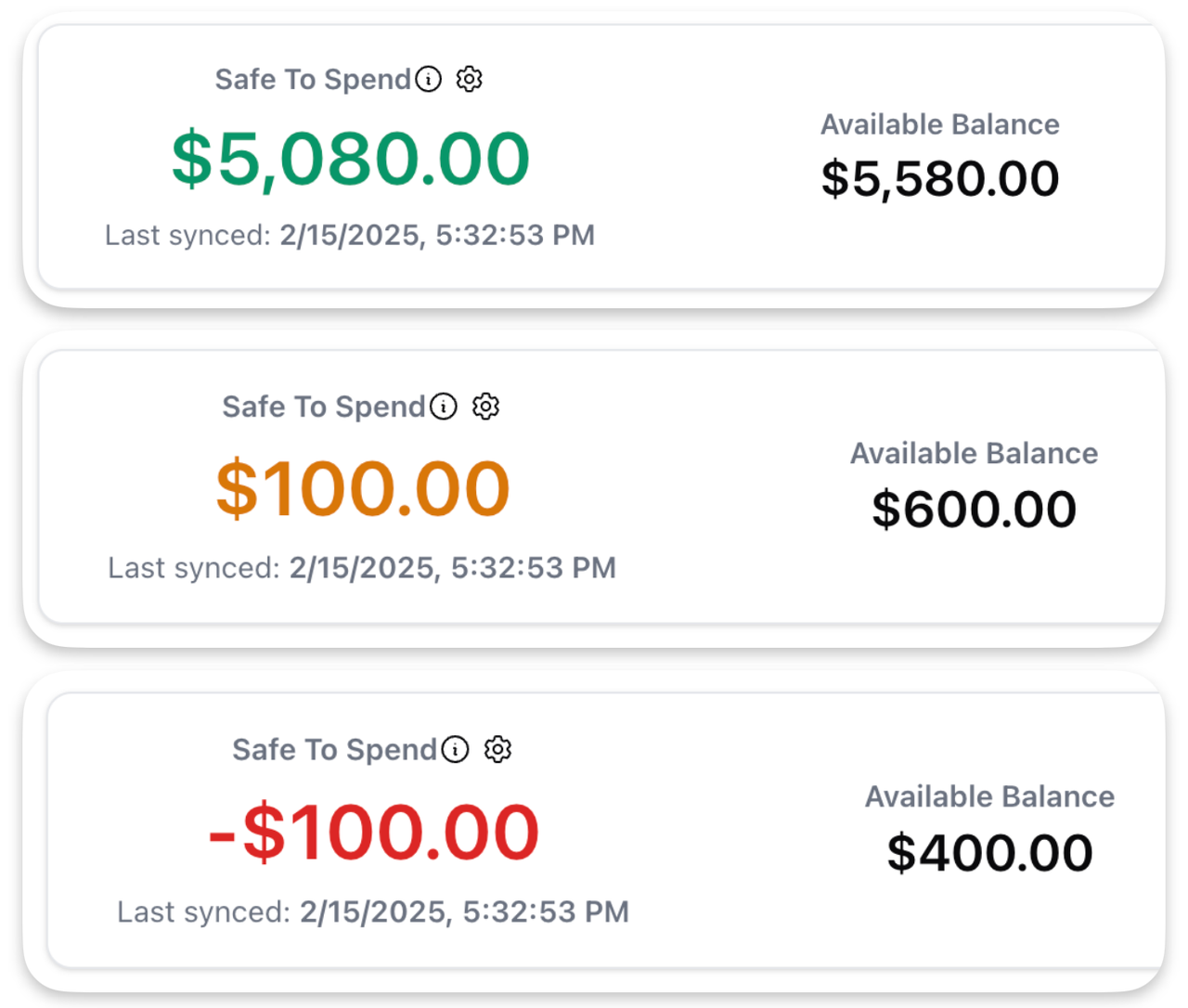

Numbers require processing. Colors don’t. When I see green, I know I can spend. Yellow means careful. Red means stop. No math required at the checkout line.

2. Real-Time Over Retroactive

By the time I remember to log that coffee purchase three days later, the damage is done. Real-time updates mean decisions based on current reality, not last week’s snapshot.

3. Automation Over Willpower

Willpower is finite, especially with ADHD. Automatic transaction import, rule-based categorization, and scheduled funding mean the budget runs itself.

4. Present-Focused Over Future-Planning

When you’re juggling multiple gigs or living paycheck to paycheck, 5-year plans are fantasy. Focus on this week, this paycheck, this moment.

5. Simple Over Comprehensive

Better to track “Can I spend?” than analyze 47 budget categories and investment allocations you don’t have.

Breaking the Cycle

Here’s how to escape the failure loop:

Accept where you are

- Not tracking investments? That’s fine—track survival first

- Multiple income streams? That’s normal for many of us

- Living paycheck to paycheck? You’re not alone

Start ridiculously small

- One account, not all of them

- “Can I spend?” not “What’s my net worth?”

- Today’s balance, not retirement planning

Build habits around existing routines

- Check your “traffic light” with morning coffee

- Let automations handle the heavy lifting

- Celebrate staying out of the red, not maximizing investments

The Budget That Finally Stuck

After 2+ years of building Cake Budget for my own ADHD brain and paycheck-to-paycheck reality, here’s what made the difference:

- No investment tracking - Just what’s in your checking

- Multiple income support - Each paycheck funds different slices

- Visual decisions - Traffic lights instead of math

- Present-focused - “Can I afford this?” not “What’s my 401k doing?”

- Built for survival - Not wealth building, just making it work

The result? For the first time in my life, I’ve stuck with a budget for over two years. Not because I suddenly developed better executive function or started earning more, but because I finally had a tool that matched my reality.

You’re Not Broken

If you’ve failed at budgeting before, it’s not because you’re bad with money. It’s because the tools weren’t built for:

- Neurodivergent brains

- Variable income

- Paycheck-to-paycheck living

- The reality of just trying to survive

You don’t need more willpower. You don’t need a higher income. You need tools that understand your reality.

Your budget shouldn’t make you feel poor for not having investments. It should help you make it to next Friday without overdrafting.

That’s possible. I promise.

Ready to try a budget built for your brain AND your reality? Start your 14-day free trial of Cake Budget. No credit card required. Just connect your bank and see your traffic light in minutes.