Why We Don't Track Net Worth (And Never Will)

Every finance app wants to show me my net worth.

Mint displays it prominently. Rocket Money puts it front and center. Personal Capital (now Empower) is basically built around it. Even YNAB tracks it.

Here’s the thing: When you’re choosing between gas and groceries, your net worth is irrelevant. When you’re juggling three gig jobs to make rent, that number is just cruel.

Cake Budget will never track net worth. This isn’t a limitation—it’s a philosophy.

The Net Worth Obsession

The finance world is obsessed with net worth because it assumes everyone’s goal is wealth building. Track your assets! Monitor your investments! Watch that number grow!

But what if you don’t have assets? What if your “investments” are making sure your kids eat this week? What if that number is negative and getting more negative?

For millions of us, net worth tracking is like being repeatedly shown a score in a game we’re not even playing.

Who Net Worth Tracking Actually Serves

Net worth matters if you:

- Have investments to optimize

- Own property that appreciates

- Can afford to think beyond next month

- Have the stability to plan for retirement

Net worth is irrelevant if you:

- Live paycheck to paycheck

- Have variable income

- Struggle with basic expenses

- Need to know if you can afford dinner tonight

Guess which group most “financial wellness” apps are built for?

The Harm of Wealth-Focused Tools

When every app shows net worth, it sends a message: “This is what matters. This is success.”

For those of us in survival mode, this creates:

- Shame: “Why is mine negative?”

- Hopelessness: “I’ll never catch up”

- Alienation: “This app isn’t for people like me”

- Avoidance: “Why even bother?”

I built Cake Budget because I was tired of apps making me feel poor for being poor.

What We Track Instead

Instead of net worth, we focus on:

Can I Spend? - The only question that matters at checkout

Days Until Payday - Because time matters more than totals

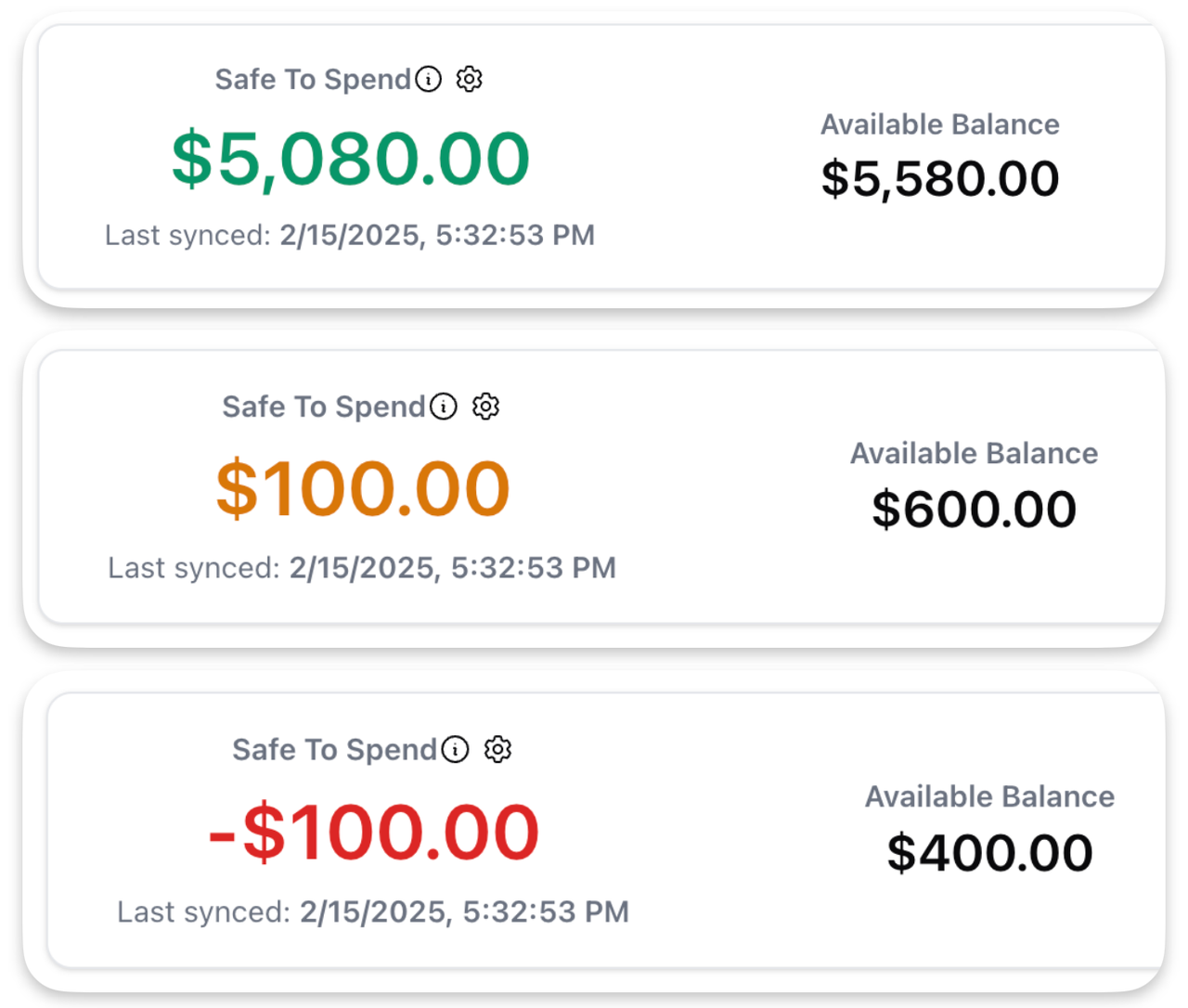

Safe-to-Spend - What’s actually available after bills

Pattern Recognition - Where money goes, not how much you’re “worth”

Survival Metrics - Did you avoid overdrafts? Stay in green? Make it to payday?

These aren’t stepping stones to wealth tracking. They’re the whole point.

The Philosophy: Survival IS Success

Here’s what we believe:

Making it to Friday is an achievement. You navigated a system designed to extract every penny, and you survived. That’s success.

Avoiding overdrafts is financial wellness. You dodged a $35 fee that could have spiraled. That’s money management.

Knowing if you can buy coffee is peace of mind. You made a decision without anxiety. That’s mental health.

Supporting your family is wealth. Even if your bank balance disagrees.

For the “Temporarily Embarrassed Millionaires”

American culture tells us we’re all just “temporarily embarrassed millionaires.” That poverty is temporary. That we should be planning for when we’re rich.

But what if we’re not embarrassed? What if we’re just trying to live?

What if financial tools served us where we are, instead of where capitalism says we should be?

Building for the 99%, Not the 1%

When I started building Cake Budget, I made a choice: This would be for people like me. People who:

- Check their balance before buying lunch

- Know exactly when payday is

- Have had cards declined

- juggle multiple income streams

- Live with financial anxiety

- Are neurodivergent and struggling

Not future millionaires. Just humans trying to make it work.

The Features We’ll Never Build

To stay true to this philosophy, we’ll never add:

- Investment tracking

- Retirement planning calculators

- Property value monitoring

- Debt-to-income ratios

- Credit score tracking

- Net worth dashboards

Other apps do those things well. They’re built for people playing the wealth game. We’re built for people playing the survival game.

What This Means for You

If you’re reading this thinking “finally, someone gets it”—Cake Budget is for you.

If you’re reading this thinking “but what about retirement planning?”—there are better apps for you.

And that’s okay. Not every tool needs to serve everyone.

We serve the paycheck-to-paycheck crowd. The gig workers. The neurodivergent. The survivors. The ones other apps ignore or shame.

Your worth isn’t a number in an app. It’s in showing up for another day, taking care of what matters, and doing your best with what you have.

That’s the philosophy. That’s why we exist.

Join thousands of others who measure success by survival, not net worth. Try Cake Budget free for 14 days. No credit card required. No judgment included.